Home >

Shipping Export Blocked, Cotton Price Trend Weak In Peak Season

As of August 31, there were 8467 cotton warehouse receipts, 200 less than the previous trading day. There are 1029 effective forecasts in 2020 / 21, 3 less than the previous trading day. The total number of the two was 9496, 203 less than the previous trading day.

On August 31, the main contract of zhengmian 2201 was weak, closing at 17270 yuan / ton, down 1.65%. On the same day, 399900 hands were traded, and the position increased by 901 to 40600. Zheng Mian 01 contract is expected to be weak, with a range of 17100-17600 yuan / T, for reference only.

On August 30, 9415.80 tons of cotton resources were sold by the reserved cotton wheel, and the actual transaction volume was 9415.80 tons, with a transaction rate of 100%. The average transaction price was 17088 yuan / ton, up 69 yuan / ton from the previous day, or 18395 yuan / ton at 3128 yuan / ton, down 82 yuan / ton from the previous day.

According to the U.S. Department of agriculture statistics, as of August 29, the U.S. boll setting rate was 86%, still significantly behind the same period last year and the average in the past five years. When 21% of the new flowers in the United States began to boll, 7% behind the same period last year and 5% in the same period of nearly five years. In the United States, the proportion of normal and good cotton plants was 96%, which was 2% higher than last week, and the overall growth was stable and good.

Recently, the problem of shipping difficulties has aroused more and more attention. Port closures caused by epidemic control measures, container shortage and soaring shipping costs (4 times the same period last year) have a more and more significant impact on foreign trade.

Some foreign trade orders issued in advance can not be transported normally even if they are completed. It is difficult to ensure the profits of the orders that can be transported abroad even in the case of soaring sea freight.

In the high cost of raw materials and unpredictable external transportation, enterprises are cautious about new foreign trade orders. The traditional gold, silver and gold may not be reproduced this year.

Although the contract in the near month of 2009 still has the support of new cotton cost, the expected decline of contract 01 in terms of consumption weakening and future economic activity and price index falling has broken the 40 day average support. Some of the newly added funds were short, and the decline of 01 was enlarged, and the price difference with 09 was expanded from 120 to 240 yuan / ton.

- Related reading

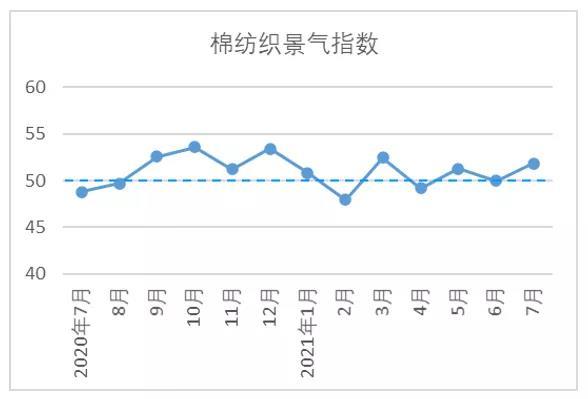

Market Analysis: Prosperity Report Of China'S Cotton Textile Industry In July 2021

|

2021/8/26 8:30:00

2

- regional economies | Japan'S Silk Trade Volume In July Was 107 Million US Dollars, Down 22.02% Year On Year

- Entrepreneurial path | "Eyes" And "Brain" Of Smart City

- Instant news | Four Textile Intangible Cultural Heritage Projects Were Selected Into The List Of 2021 National Cultural, Tourism, Scientific And Technological Innovation Project Reserve

- market research | The Power Of Brand: From Luxury Brand As A Century Old Brand In The Process Of Digital Transformation

- neust fashion | Fashion Trend: Spring And Summer 2023 Retro New Sports Theme Color Trend

- Professional market | Focus On The Development Of Futures Market: Actively Promote The Research And Development Of Carbon Futures And Serve Small And Medium-Sized Enterprises

- Financial management | Close Of Public Offering In 2021: The Total Profit Of The Fund Is 650 Billion Yuan, And The Matthew Effect Is Remarkable, And The Management Fee Increases By Nearly 70% Year On Year

- Gem | The Tide Of Lifting The Ban On Science And Technology Innovation Board Is Surging

- Listed company | The First Case Of Core Technology Held By The Actual Controller Of Science And Technology Innovation Board: Exclusive Response: There Is No Capital Injection Plan For External Shareholders

- Guangdong | Guangzhou Held A "Second-Hand House Reference Price" Big Move, Many Second-Hand Housing To Bubble

- 全球及中国棉花市场形势分析

- Analysis Of Global And Chinese Cotton Market Situation

- Promote The Modernization Of Industrial Chain Development! The 4Th Standing Council Of The 8Th China Textile Machinery Association Will Be Held Soon

- 30 Years Of Jiang Fu · Dan Xin Pu | Adherent Of Chinese Painting Teaching -- Bao Mingyong

- Japan'S Silk Trade Volume In July Was 107 Million US Dollars, Down 22.02% Year On Year

- "Eyes" And "Brain" Of Smart City

- Four Textile Intangible Cultural Heritage Projects Were Selected Into The List Of 2021 National Cultural, Tourism, Scientific And Technological Innovation Project Reserve

- The Power Of Brand: From Luxury Brand As A Century Old Brand In The Process Of Digital Transformation

- Fashion Trend: Spring And Summer 2023 Retro New Sports Theme Color Trend

- Focus On The Development Of Futures Market: Actively Promote The Research And Development Of Carbon Futures And Serve Small And Medium-Sized Enterprises