Which Is Stronger Between Jingdong Vip.Com And Poly America? Revenue Fell

As Dangdang announced the third quarter earnings report, the main domestic B2C enterprises have announced the quarterly earnings report.

Comparing the B2C data, we can find a phenomenon, all growth has slowed down, net profit has deteriorated, poly America has suffered its first loss in 2 years.

Jingdong group's gross profit margin in the third quarter was 6 billion 95 million yuan, a substantial increase over the same period last year. Jingdong's gross profit margin in the third quarter was 13.8%, up 1.6 percentage points from the same period last year, a 0.9 percentage point increase from the previous quarter.

Vip.com

Gross profit in the third quarter was 2 billion 160 million yuan ($339 million), an increase of 63% over the same period last year, up from 1 billion 330 million yuan in the same period last year.

Vip.com's gross profit margin in the third quarter was 24.9%, unchanged from the same period last year.

Dangdang's gross profit margin was 369 million yuan in the third quarter, and its gross margin was 15.6%, down from 18.9% in the same period last year, but higher than the 14.8% in the second quarter of 2015.

Jumei.com

The gross profit in the third quarter was 508 million 200 thousand yuan (about 79 million 950 thousand dollars), up 37.8% from 368 million 900 thousand yuan in the same period last year.

Gross profit accounted for 26.2% of net revenue, down from 38% in the same period last year.

Jumei.com's gross margin decline is mainly due to the cosmetics of the third party platform.

Sales business

Transfer to self employment.

Gross profit accounted for 22.3% of total net pactions, slightly higher than 21.9% of the same period last year.

The gross profit of jumei.com's proprietary business in the third quarter accounted for 24.1% of the net paction volume of proprietary business, down from 29.4% in the same period last year.

The decline is mainly due to the inventory optimization activities of poly American duty-free shops.

According to the financial report, Jingdong's net income in the third quarter was 44 billion 100 million yuan (about 6 billion 900 million US dollars), an increase of 52% compared to the same period last year, a decrease of 4%.

The latest change of Jingdong is that the strategic investment of Hainan Airlines is $500 million. After completion, HNA tourism will become the largest shareholder of road cattle, holding a 24.1% stake in road cattle.

With the investment of Hainan Airlines, Jingdong lost the status of the largest shareholder of road cattle.

Vip.com's net revenue in the third quarter was 8 billion 670 million yuan ($1 billion 360 million), an increase of 63% over the same period last year.

Vip.com's revenue is lower than expected. The official explanation is that the weather in China this autumn is warmer than expected, causing users to postpone the purchase of costumes for autumn and winter.

Vip.com's revenue was lower than expected, which once led to a sharp fall in vip.com's share price and also suffered from Jingdong's "God fill knife".

Jingdong mall CEO Shen Haoyu said in a conference call that the weather has not yet seen a substantial impact on sales of Jingdong's clothing category. Jingdong has just passed a very successful double eleven promotion, and sales of clothing categories are growing healthily.

Dangdang's total net revenue in the third quarter was 2 billion 371 million 900 thousand yuan (US $373 million 200 thousand), an increase of 22.6% over the same period last year.

The third quarter of the United States revenue was 1 billion 900 million yuan, an increase of 99.9% over the same period last year, representing a slight decrease compared with the previous quarter.

The growth of poly US net revenue is mainly due to the growth of the fast selling duty-free shops in the United States, the growth of the number of active users and total number of orders brought by the third party platform cosmetics sales business to self pfer.

- Related reading

China'S Imports Of Cotton Yarn Increased By 21.93% In The 1-10 Months Of 2015.

|

Online Retail Sales Continue To Grow Rapidly, 1-10 Months, Rising Clothing Business Performance

|

China Textile City Third Weeks November Main Staple Classification Sales Volume

|- Trend of Japan and Korea | What Elements Do Korea Wear In Winter To Dress Up Quickly?

- Collocation | Three Ways To Match Fur Coat

- Fashion item | 冬天牛仔裤怎么搭 潮人带你触摸时尚

- international master | Why Do These Two Companies Choose To Enter The Clothing Market From Children'S Clothing?

- neust fashion | Fur Coat Is Very Fashionable And Luxurious. It Gives You The Most Beautiful Experience.

- Domestic data | "One After Another" In The Post Crisis Era Of Foreign Trade

- Standard quality | Han Du Yi House Two Times Boarded The Black List.

- Industry Overview | Export Products Can Not Be Standardized.

- Design Institute | How Can Prada, A Luxury Brand Who Has Fallen To The Bottom, Save Himself?

- Learning Area | How To Deal With Brands Such As Daphne And Lining In The Winter Of Clothing Retailing?

- Hugo Boss预警2016年业绩 边走边摸底

- Ralph Lauren Push Interactive Dressing Room Set Off Technological Frenzy

- Woolen Coat + Skirt

- How To Match The Woolen Coat Is Nice Enough.

- Long Coat With Skirt, Street Interpretation Of European And American Style

- How To Match Sweater Coat With The Tide People Can Be Very Beautiful, Amazing.

- Eastern Silk Market: Flat Pattern Sales Are Weak.

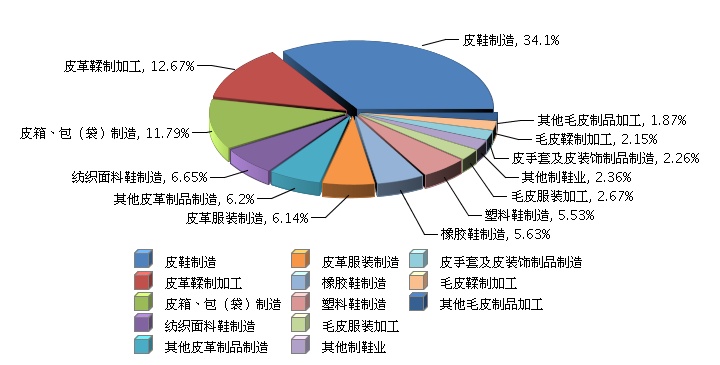

- Leather Accessories Are Booming And The Supply Chain Is The Winner.

- Decipher The Taobao Brush Group: The Brush Is Sitting And Waiting For Death

- Specialization, Standardization Of Vertical Cross-Border Electricity Supplier Market Will Be Bigger And Bigger.